Blog

Home > Non Profit

Strengthening Partnerships for Cooperative Approaches

By: Adminalliance

Comments: 0

In a first of its kind event co-organized by the Eastern and West African Alliances on Carbon Markets and Climate Finance, many countries from Eastern and West Africa joined the online roundtable event that brought together countries looking to transfer and acquire internationally transferred mitigation outcomes (ITMOs). The event showcased and discussed existing and emerging initiativespiloting cooperative approaches under Article 6.2.

These Initiatives are driven by countries, multinational and national institutions, such as Japan (JCM), Klik Foundation (Switzerland), World Bank (Ci-Dev) the Swedish Energy Agency (SEA) as well as the Nordic Environment Finance Corporation (NEFCO) and are in different stages of cooperation. The participants had the chance to get an insight on the different initiatives and their engagement models, share country experiences, and also exchange on how to make cooperative approaches work.One of the conclusions was that host countries require a strong institutional set up in the respective countries with decision authority and the political mandate to engage in cooperative approaches. This will require capacity building and awareness raising amongst different actors in Eastern and West African countries.

African countries are preparing for Article 6 negotiations in 2021

By: Adminalliance

Comments: 0

African countries are committed to continue the engagement and dialogue on crunch issues of Article 6, despite of the delayed inter-sessional (52nd Subsidiary Bodies Meeting) and COP26 negotiations in 2021 caused by the COVID 19 pandemic. The Eastern and West African Alliances on Carbon Markets and Climate Finance organized an event titled Consultations on Article 6 where African countries discussed key issues of Article 6 from an African perspective.

The presenters such as El Hadji Mbaye Diagne – Lead Negotiator of the AGN, Mandy Rambharos (South Africa) as well as Sandra Greiner (the Gambia) and Perumal Arumugam (UNFCCC) reflected upon COP25 and unpacked some key issues of Article 6 on Share of Proceeds, Corresponding Adjustments, OMGE and many others.The participants from different African countries, including countries from the Eastern African Region, shared their views and concerns on Article 6 and agreed that the delayed negotiations of Article 6 present an opportunity for the continent to thoroughly prepare and coordinate the stance of the African continent on Article 6.The event was also organized with support from the GIZ Global Carbon Markets Project Uganda/East Africa as well as the UNFCCC Regional Collaboration Centers of Kampala and Lomé.

Kenya Youth Carbon Markets Training

By: Adminalliance

Comments: 0

Following a request submitted to the Eastern African Alliance on Carbon Markets and Climate Finance by the Kenyan Alliance National Focal Point, the Alliance, in collaboration with GIZ, UNFCCC-RCC Kampala, Africa Youth Initiative on Climate Change (AYICC-Kenya), organized a carbon markets workshop training for Kenyan youth/young professionals from 15th June 2021 to 17th June 2021.

The aim of the workshop was to raise awareness on carbon market activities in Kenya and on the status of negotiations under Article 6 of the Paris Agreement. Itstrengthened key youth institutions and young professional stakeholders’ knowledge of carbon market mechanisms, explored the opportunities available for the youth to engage in the implementation of Article 6, discussed lessons learned from CDM implementation and linkages of the new market mechanisms to NDCs.

The virtual training workshop brought together a targeted group of young professionals and key youth institutions across Kenya with representatives from the public and private sector, financing institutions, and technical experts.

The young professionals were taken through subject matter on carbon markets as a policy instrument, foundations on the UNFCCC, the journey from the Kyoto Protocol to the Paris Agreement, the Carbon Asset Project Development Cycle, Carbon Standards, Transactional costs, calculations of emission reductions,, and Article 6 of the Paris Agreement. Knowledge was tested with quizzes and with interactive features incorporated such as polls and brain break exercises.

The workshop training also featured Kenyan guest speakers with vast experience such as the presentation given by Ms. Clarice Wambua, Partner at Cliffer Dekker Hofmeyr, on carbon markets as a policy instrument and Mr. David Lubaga, a verifier with Tuv Nord, on the role of the auditor. Young professionals working in the space provided a project developer perspective and insight into different sectoral projects in natured based solutions, electricity generation and improved cookstoves. This included Ms. Christina Ender (Conservation International), Stanley Kiraoku (KenGen) and Sally Gakii and Lillian Kagume (Climate Care) respectively. More than 60 youth and young professionals attended the three days sessions. Although it was primarily targeted at a Kenyan audience there was representation from the region and Alliance member countries Rwanda, Sudan and Uganda with participants nominated by the Alliance focal points.

Watch the sessions here

Analyzing the Eastern African Carbon Market Portfolio

By: Adminalliance

Comments: 0

The Clean Development Mechanism (CDM) of the Kyoto Protocol saw minimal benefit for the African continent in terms of issuance of Certified Emission Reductions (CERs). This however did not mean that carbon market activities did not take place. The Eastern African region has a sizeable portfolio of projects and the countries are concerned as to the fate of CDM projects and Programme of Activities (PoAs) through the transition into Article 6 of the Paris Agreement.

The Eastern Africa Alliance on Carbon Markets and Climate Finance organized a workshop on ‘Analyzing the Eastern African Carbon Market Portfolio’ at the annual Innovate 4 Climate global Conference held 25-27 May 2021. The session focused on sharing the lessons learned from the CDM project data and trends and further understanding the role the voluntary carbon markets have played in the region and potential moving forward. The analysis focused on the seven Alliance member countries of Burundi, Ethiopia, Kenya, Rwanda, Sudan, Tanzania, Uganda, for which individual country carbon profiles were developed in 2021 in addition to a synthesis profile document for the region.

Mr. Timothy Cowman, the technical lead for the analysis and a representative of the Climate Finance Innovators mentioned that, there are a total of 465 registered Clean Development Mechanism activities, 53 projects and 412 CPAs within 58 program activities in these seven countries. The East Africa region takes a share of 52% of all issued projects in Africa. 60% of these projects are reaching the expiry of their crediting period in 2022 with significant untapped potential which could assumedly be explored considering the mitigation potential that could reach 225 million tCO2e for the period 2021-2030. The Voluntary Carbon Market standards (Gold Standard, Verra, and Plan Vivo) are more significant in issuance volumes than the CDM, realizing issuance of more than 37million credits. Mr. Cowman further shared some interesting developments in the region in relation to the transition to Article 6 of the Paris agreement including regional participation in Japan’s Joint crediting Mechanism, the World Bank’s Standardized Crediting Framework, the Adaptation Benefit’s Mechanism and CORSIA..

Mr. Owen Hewlett from the Gold Standard Foundation gave an overview of the foundation’s work in labelling CDM credits and issuing of voluntary credits and envied that role continuing to the future with article 6.2. The foundation is developing views on how voluntary markets certification can be used to serve article 6.2. There is a lot of interest in scaling up the voluntary carbon market and it can be a good tool to bring finance to the region. He emphasized the importance to protect those good and vulnerable projects that are at a risk of discontinuation, and relatedly the Gold Standard recently adopted new rules to allow CDM projects to transition to the Gold Standard while maintaining their CDM registration. Another key point raised was around the need for developers to be intentional about the kind of finance they would want to attract and the sectors they look to consider more in line with their country NDCs..

Ms. Anne Omambia shared Kenya’s perspective on the carbon market profiles emphasizing on the county’s participation in the voluntary carbon market, Gold Standard especially for cookstoves, Plan Vivo and Verra and the country’s readiness process to participate in the REDD+ mechanism. Kenya have submitted an updated conditional NDC with slightly raised ambition and commitment to actively participate in carbon markets. Ms. Omambia highlighted key experiences for Kenya regarding participation in carbon markets including key trainings to enhance understanding of carbon markets, an interest from the Banking sector to provide upfront financing to leverage CDM investments during the earlier years, and also saw a need to have skilled technical experts to participate in the carbon markets. Kenya has a lot of interest in Article 6 and hopes to actively engage in it to contribute to emission reductions and sustainable development.

A development Partners perspective on the carbon profiles was shared by Ms. Ritah Rukundo from GIZ who mentioned that the experience built overtime through the CDM and voluntary carbon markets is of advantage for development partners to assist countries transition to Article 6 of the Paris Agreement. She mentioned that there is potential for diversification of sectors under the carbon markets to include for instance projects in the transport sector and other innovative technologies to attract investment. Understanding that the supply side of the carbon market is majorly private sector led, Ms. Rukundo emphasized the importance to encourage alignment of private sector projects to country NDCs and Long-term strategies. For effective participation in the new market mechanisms under Article 6, institutional and legal frameworks, and regional cooperation would be key aspects for countries to strengthen.

Participants engaged in discussion around the contributions made by the speakers including questions on the incorporation of carbon markets in Kenya’s LTS, wherein Ms. Omambia responded that Kenya is in the informative stage of developing its LTS and like all other regulatory documents envisages to include carbon markets in their LTS . Participants also raised questions regarding measures to increase prices for voluntary certificates-Mr. Hewlett in response emphasized a shift from the offset mentality to social cost mentality and that quality of projects drives price. Another interesting question raised was on measures to raise awareness on CDM and carbon pricing for which Bianca responded in line with the activities of the Alliance to serve this purpose, and encouraged participants to visit the Alliance website for updates on carbon market discussions. Tim further encouraged enhancement of internal capacity overtime through engaging in capacity building activities.

Details on this session can be found here.

Delivery of online training on preparing climate finance proposals for NDC implementation in Rwanda

By: Adminalliance

Comments: 0

As the first country to submit an updated NDC in Africa, Rwanda’s pioneering action has set mitigation and adaptation priorities and targets across various sectors. With climate finance playing a key role in its NDC implementation, building capacity to develop bankable project proposals to access these funds is crucial.

To enhance knowledge and skills in this area, Rwanda requested the Eastern Africa Alliance on Carbon Markets to train Civil Society Organizations and sector experts on how to access climate finance, with a high focus on accessing the Green Climate Fund (GCF). The Alliance in collaboration with REMA, GGGI, GIZ on behalf of BMU and the UNFCCC’s Regional Collaboration Center Kampala, organized a a six week online course on preparing climate finance proposals from March 25th to April 29th 2021.

Participants were taken through the requirements in developing GCF concept notes and proposals in topics ranging from barrier analysis, project structure and design, climate rationale, investment criteria and project budgeting. Further to this the climate finance landscape with other sources of climate finance was expounded on.

Prior to start of the training, participants submitted Project Idea Notes and during the sessions they had the opportunity to practically apply what they had learned to improve on their initial submissions. Overall, 42 consistent participants successfully completed the training providing an opportunity to scale up the activity to the other Alliance member countries.

Member Countries adopt the Alliance Workplan and Major Framework Documents

By: Adminalliance

Comments: 0

The Eastern Africa Alliance on Carbon Markets and Climate Finance held their first members meeting online, due to current COVID 19 restrictions. During the meeting country members discussed and adopted a number of Framework Documents crucial for operationalizing the young Alliance.Furthermore, the new Chair of the Alliance Members Meeting, Dr. Anne Omambia (Alliance National Focal Point in Kenya), was announced. Dr. Anne Omambia, who will chair the Alliance member meeting for one year, welcomed the adoption of the Rules of Procedures, the Communication Strategy as well as the Alliance Workplan, from member countries, Ethiopia, Burundi, Rwanda, and Uganda. The work plan was developed based on the member’s needs and will guide the activities implemented under the Alliance.

Preparing for Carbon Taxes in Africa

By: Adminalliance

Comments: 0

The Eastern and West Africa Alliances on Carbon Markets and Climate Finance collaborated to offer a new online course focused on carbon taxes for policy makers in their respective member countries. It took place between the weeks of April 5 to April 23, 2021 with two 2hour sessions per week.

The course provided participants with the opportunity to learn about the basic principles of carbon tax choice, design, and deployment with an emphasis on applications in the Africa context. It provided interactive online lectures, insights from Africa’s leading practitioners in the field, and supervised exercises focused on the participants’ home countries. Participants who satisfactorily complete all of the course requirements were awarded a certificate.

The course was organized around six modules:

- Why Carbon Taxes? A module focused on basic economic concepts, the range of policy instruments to address climate change and how they compare. Guest Speaker: Peter Odhengo – Senior Policy Advisor Climate Finance/Green Climate Fund NDA, National Treasury

- Preparing for Carbon Tax Design. A module to examine the steps of carbon tax design, identification of objectives (e.g. greenhouse gas emission mitigation, revenue raising, and/or co-benefits), important country-specific factors, and broad design principles. Guest Speaker: Andrew Gilder – Director Carbon Legal South Africa

- Basics of Design and Assessment. A module to review the process of setting the tax base and rate, including a review of potential design approaches and modeling.

- Addressing Carbon Tax Effects. A module to assess cobenefits of carbon taxes as well as potential negative secondary effects, how to design a carbon tax to account for both, and handling of revenues raised from the carbon tax. Guest Speaker: Memory Machingambi – Senior Economist, National Treasury of South Africa

- Modelling carbon taxes. A module to consider institutional design issues, dynamic rollout, MRV (monitoring,reporting, and verification), and communications. Guest speaker: Haileselassie Medhin – Africa Director Of Strategy And Partnerships, WRI

- Evaluating and Adjusting Carbon Taxes. A module to review the importance of carbon tax performance in the years following implementation, the organization of reviews, and adjustments. Guest Speaker: El Hadji Mbaye Diagne – Director General, Africa Energy Environment/ CDM Executive Board Chair

It is hosted by St. George’s University on their SGUx platform. The course development was financially supported by the Collaborative Instruments for Ambitious Climate Action (CiACA) initiative, managed by the UNFCCC, and Banque Ouest Africaine de Developpement (BOAD), with technical support from RCC Kampala, RCC Lome and the World Bank.

The lead trainer was Kenneth Richards, a professor of economics, law and sustainability at the O’Neill School of Public and Environmental Affairs, Indiana University. He was supported by Emily Giovanni, a Senior Consultant for Gnarly Tree Sustainability Institute. Their team has worked extensively in carbon pricing and environmental taxes for the World Bank and collaborated with governments in Africa, Asia, and Latin America to analyze and design carbon taxes and related instruments.

The course is now publicly available here

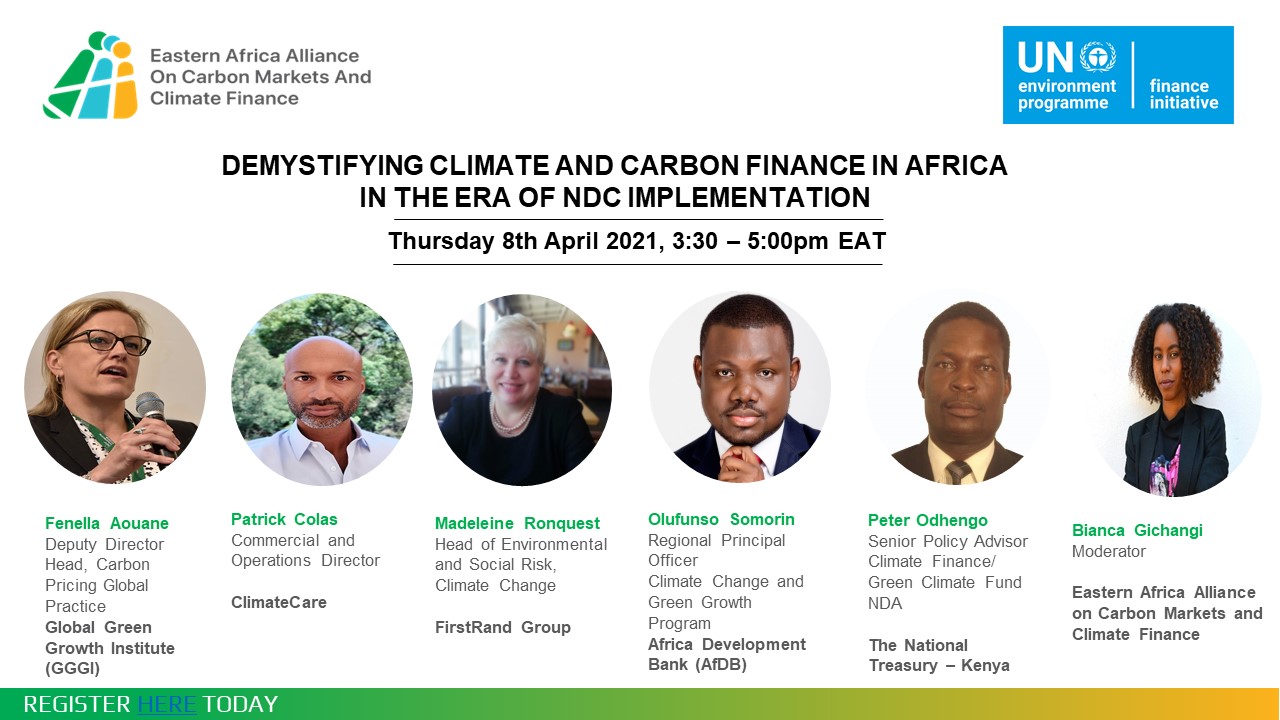

Demystifying climate and carbon finance in Africa in the era of NDC implementation

By: Adminalliance

Comments: 0

Amidst a global pandemic and the high vulnerability of African countries to the impacts of climate change, countries in the continent are working towards implementing Nationally Determined Contributions (NDCs) and a green recovery. A common feature of NDCs in Africa is the requirement of accessing significant amounts of international finance to implement them. This creates a huge role for climate finance. Innovative financial instruments are essential towards financing both adaptation and mitigation. Countries have expressed the for both access to climate finance and the intention to use carbon market mechanisms.

The Eastern Africa Alliance on Carbon Market and Climate Finance hosted its first climate finance event in collaboration with UNEP FI, a leading global initiative that collaborates with the financial industry consisting of banks, insurers, and investors. The event explored the meaning of carbon and climate finance in relation to NDCs and expounded on issues around transparency and accounting, ambition and attribution.

From the financial institution perspective, commercial banks have an opportunity to tap into several new and innovative ways of financing ranging from blended finance, exploring carbon markets, renewable energy, green equity, pricing externalities while aligning to the NDC priorities of the countries they are in. The DFI perspective shed light on current practice and shared insight into important factors, such as capacity, that ensure climate finance flows.

The private sector outlook provided highlights on experience in mobilizing carbon finance, views on potential future approaches and mechanisms, the importance of working with government and the role of the voluntary carbon market. Lastly, we explored government practice with insight on accessing climate finance in Kenya.

The expert panel comprised of Fenella Aouane – Deputy Director, Head Carbon pricing Global Practice, Global Green Growth Institute (GGGI), Patrick Colas – Commercial and Operations Director, ClimateCare, Madeleine Ronquest – Head of Environmental and Social Risk, Climate Change – FirstRand Group, Olufunso Somorin – Regional Principal Officer, Africa Development Bank (AfDB) and Peter Odhengo – Head of the Green Economy Unit and programme coordinator, FLLoCA/ Green Climate Fund NDA – The National Treasury, Kenya.

Watch here for deeper insights into the discussion.

Eastern Africa carbon market engagement: Regional foundations for Article 6 implementation

By: Adminalliance

Comments: 0

The Eastern Africa Alliance on Carbon Markets and Climate Finance with support from the GIZ Global Carbon Markets Programme, the UNFCCC Regional Collaboration Centre in Kampala, Carbon Africa and Perspectives Climate Group hosted a private sector series on carbon market engagement on the 21st, 23rd and 25th of September 2020.

The private sector is instrumental in ensuring the success of Article 6 activities in the Eastern African region once the guidance on cooperative approaches and the rules on the new mechanism come into play. They mobilise investment and bring in projects with new technologies contributing to low carbon and climate resilient development in these countries. Carbon market activities in the Eastern African region are not new as countries have already taken part in the Clean Development Mechanism (CDM) and voluntary carbon standards activities. Therefore, the main aim of the dialogues was to build readiness for the potential CDM transition and future implementation of Article 6 amongst existing and aspiring carbon asset developers.In addition to the developers the participants ranged from technical experts and development partners to financial institutions representatives.

The series commenced with a status update on international climate change negotiations on Article 6 by the UNFCCC Secretariat and a presentation on the road to COP 26 by the incoming Presidency represented by the UK Government. The session gave insight into how the decisions made at the international level can catalyse actions leading to real impact from the potential in the cooperative approaches to come. To understand where the region is going it was important for participants to understand where it was coming from. Climate Finance Innovators provided an overview of the Eastern Africa profile with statistics on CDM project and programme of activities (PoA) registrations, sectors, issuances as well as Gold Standard and Verra activity. It highlighted what was at stake as the region moves in implementation of Article 6.

Regarding the existing portfolio the topic on transition was a core issue. The UNFCCC gave insights on the different aspects of transition of infrastructure, activities and units with Perspectives Consulting Group providing a presentation on the same from an independent technical expert view. Despite the existing optimism of project developers , regardingincoming Article 6 rules, there is a need for clarity on transition for existing assets. The uncertainty related to Article 6 is currently impacting business operations and is raising questions, for example on whether to undertake verification audits, or making decisions on further investment.

The second session had a significant focus on key features of Nationally Determine Contributions (NDCs) and the relation to carbon market activities. Participants were taken through the NDC processes in such as the NDC updates to be submitted by 2020 and every 5 years. As governments will be tracking and reporting on NDC activities there will need for clarity on the role and responsibilities of government and private sector regarding the transfer of ITMOs in relation to NDC implementation.

As countries agreed at the negotiations to apply corresponding adjustments to avoid double counting, the session further explored the concept, its relevance to tracking and reporting as well as the associated risks. Governments in the region, that will be hosting activities, need to plan carefully what amount of units are to be transferred internationally or used domestically towards the NDC so as not to overshoot their target and ensure they can report on Article 6 activities transparently. For this institutional frameworks and infrastructure, such as registries, are required. With the incoming of NDCs, which were not present under the Kyoto Protocol, there is further work to be done in revisiting concepts such as additionality.

The sessions were followed by a panel of distinguished speakers from the voluntary carbon market (VCM) space, such as Verra and Gold Standard, together with project developer voices, PD Forum and ClimateCare. They took participants into a rich on recent VCM developments, actions towards corresponding adjustments and views on transition. Participants were reminded on the need of speeding up climate action through scaling activities with both the standards and the project developers noting significant increased demand from corporates for emission reduction units and their services. The ongoing Article 6 negotiations and developments led to in depth discussion on whether corresponding adjustments are required or not and how labelling options for units, for example as Article 6 compliant, are being developed. The line between voluntary and compliance standards is also changing and is not so clearly defined, with voluntary standards being used in domestic compliance markets and CORSIA making transparency even more important. It was also important to ensure there be a balance with regulation implemented to ensure years of building cooperate support for lowering emissions is not jeopardised.

As the series drew to a close the last session focused on piloting Article 6 which has already commenced in several African countries. These activities can not only be viewed as a source of investment into the country but also have the units as an export product. There is a movement to upscaling activities and the need for policies to drive this. The private sector provides good businesses cases for proposed projects and undertake risk assessments. These are some of the factors the Swiss the KliK foundation look for in private sector engagement with their activities in Africa already covering Ghana, Senegal, Morocco with strong interest from Uganda and Kenya. It was expressed that they were very close to finalising a bilateral agreement with Peru that would provide a real case on matters corresponding adjustments and sustainable development.Furthermore, they were open to building on existing activities therefore upscaling of PoAs was welcome, providing an option to developers in the region.

On a policy level the Gold Standard has been advocating for sustainable development practices and application of best practices in Article 6 piloting. Currently they are developing an additionality framework for cooperative approaches leading to ambitious sustainable development outcomes and reducing the risk of seller countries overselling. It was noted that several Interministerial committees are already in place in different African countries indicating countries are actively preparing for Article 6 implementation. The representative from the South African government took participants through the process of establishing South Africa’s carbon tax. The design of the tax allows for use of offsets that provided a 5-10% tax liability relief, acting as an initial incentive to be ramped up over time. Eligible Offsets can be derived from CDM, gold standard and Verra projects developed in South Africa as these already have well established methodologies to provide an incentive in the beginning and the tax ramped up later in time.

This series provided participants with the latest information on carbon market developments and the opportunity to interact with the industry’s leading experts. The Alliance would like to thank the distinguished speakers from the UNFCCC Secretariat, the UK Government, Perspectives, Climate Finance Innovators, Verra, Gold Standard, PD Forum, ClimateCare, The KliK Foundation and the South African Government for contributing to the series.

Please find the presentations here

COP25 Review: Article 6- What is in for Eastern Africa

By: Adminalliance

Comments: 0

Delegates went into COP25 negotiations knowing Article 6 was in the limelight, though not for positive reasons. In Katowice, the previous year, discussions on markets did not lead to agreement which effectively left the Paris Rulebook incomplete. It was hoped that the climate talks, in Madrid under the Chilean Presidency, would present a better outcome however matters remain unresolved. Given the complexity of some of the issues, both technically and politically, it could not be ascertained that a decision would be reached in Madrid. The negotiations, with the aim of getting an outcome on the guidance on cooperative approaches and the rules of the 6.4 mechanisms will continue at COP26, Glasgow.

As the negotiations continue internationally, it is key to understand what it means for member countries in the Eastern Africa Alliance on Carbon Markets and Climate Finance. The difficult issues being discussed on the global stage such as the transition of CDM activities and units, share of proceeds from cooperative approaches and avoiding double-counting have relevance to the region. Africa did not benefit much in the past from CDM however navigating this new generation of markets under Article 6, in line with NDC implementation, is a priority for the members (Burundi, Ethiopia, Uganda, Tanzania, Rwanda and Kenya). The fate of the Eastern African CDM project and program of activities portfolio depends on a decision. Members also need to ensure that they are adequately prepared to apply corresponding adjustments in the transfer of Internationally transferred mitigation outcomes (ITMOs). Alliance countries also have to ensure that share of proceeds towards adaptation will provide predictable finance to address priority adaptation needs.

There was a concern as to how no decision at COP25 would affect carbon market activity with the operation of the Paris Agreement upon us in 2020. Cooperative approaches, which are essentially bilateral agreement activities between countries that use market mechanisms, can occur with or without defined rules for Article 6. However, to use it towards NDC implementation it is extremely crucial to have a decision on the guidance to cooperative approaches to ensure environmental integrity and transparency. Pilots activities will continue which shows interest in market mechanisms and some countries are signing onto the San Jose Principles. These were launched towards the end of COP25 and are aligned to having robust markets that are high in environmental integrity. A decision is still needed to speed up activity and involve the private sector as pilots are currently being driven by governments and Development Financial Institutions such as the World Bank.

In preparation for COP26, the alliance member countries can set up the institutional frameworks required and undertake strategic assessments of their sectors to develop project pipelines. As Article 6 remains technical and full of jargon, the Alliance works towards communicating relevant developments in the area to the members to facilitate their NDC implementation.

Read the full review article on COP25 here

Sidebar