Blog

Home > Non Profit > Demystifying climate and carbon finance in Africa in the era of NDC implementation

08

AprBy: Adminalliance

Comments: 0

Amidst a global pandemic and the high vulnerability of African countries to the impacts of climate change, countries in the continent are working towards implementing Nationally Determined Contributions (NDCs) and a green recovery. A common feature of NDCs in Africa is the requirement of accessing significant amounts of international finance to implement them. This creates a huge role for climate finance. Innovative financial instruments are essential towards financing both adaptation and mitigation. Countries have expressed the for both access to climate finance and the intention to use carbon market mechanisms.

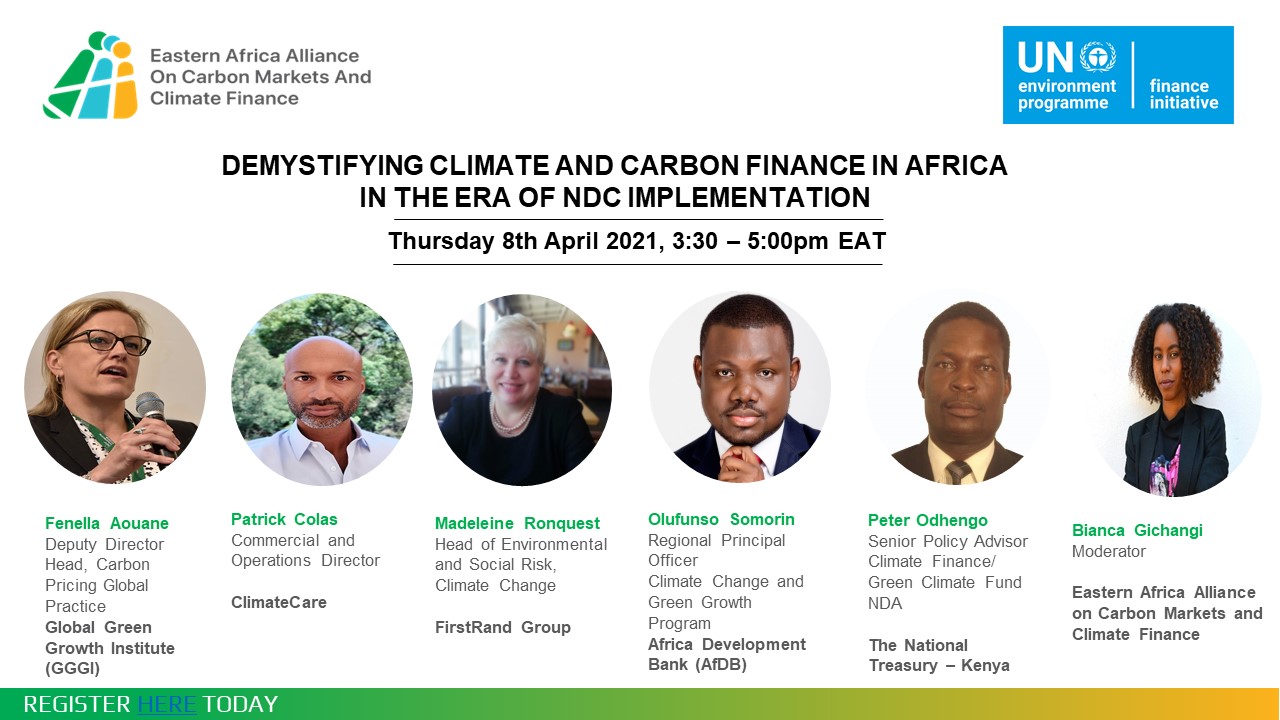

The Eastern Africa Alliance on Carbon Market and Climate Finance hosted its first climate finance event in collaboration with UNEP FI, a leading global initiative that collaborates with the financial industry consisting of banks, insurers, and investors. The event explored the meaning of carbon and climate finance in relation to NDCs and expounded on issues around transparency and accounting, ambition and attribution.

From the financial institution perspective, commercial banks have an opportunity to tap into several new and innovative ways of financing ranging from blended finance, exploring carbon markets, renewable energy, green equity, pricing externalities while aligning to the NDC priorities of the countries they are in. The DFI perspective shed light on current practice and shared insight into important factors, such as capacity, that ensure climate finance flows.

The private sector outlook provided highlights on experience in mobilizing carbon finance, views on potential future approaches and mechanisms, the importance of working with government and the role of the voluntary carbon market. Lastly, we explored government practice with insight on accessing climate finance in Kenya.

The expert panel comprised of Fenella Aouane – Deputy Director, Head Carbon pricing Global Practice, Global Green Growth Institute (GGGI), Patrick Colas – Commercial and Operations Director, ClimateCare, Madeleine Ronquest – Head of Environmental and Social Risk, Climate Change – FirstRand Group, Olufunso Somorin – Regional Principal Officer, Africa Development Bank (AfDB) and Peter Odhengo – Head of the Green Economy Unit and programme coordinator, FLLoCA/ Green Climate Fund NDA – The National Treasury, Kenya.

Watch here for deeper insights into the discussion.

Sidebar