Blog

28

AprBy: Adminalliance

Comments: 0

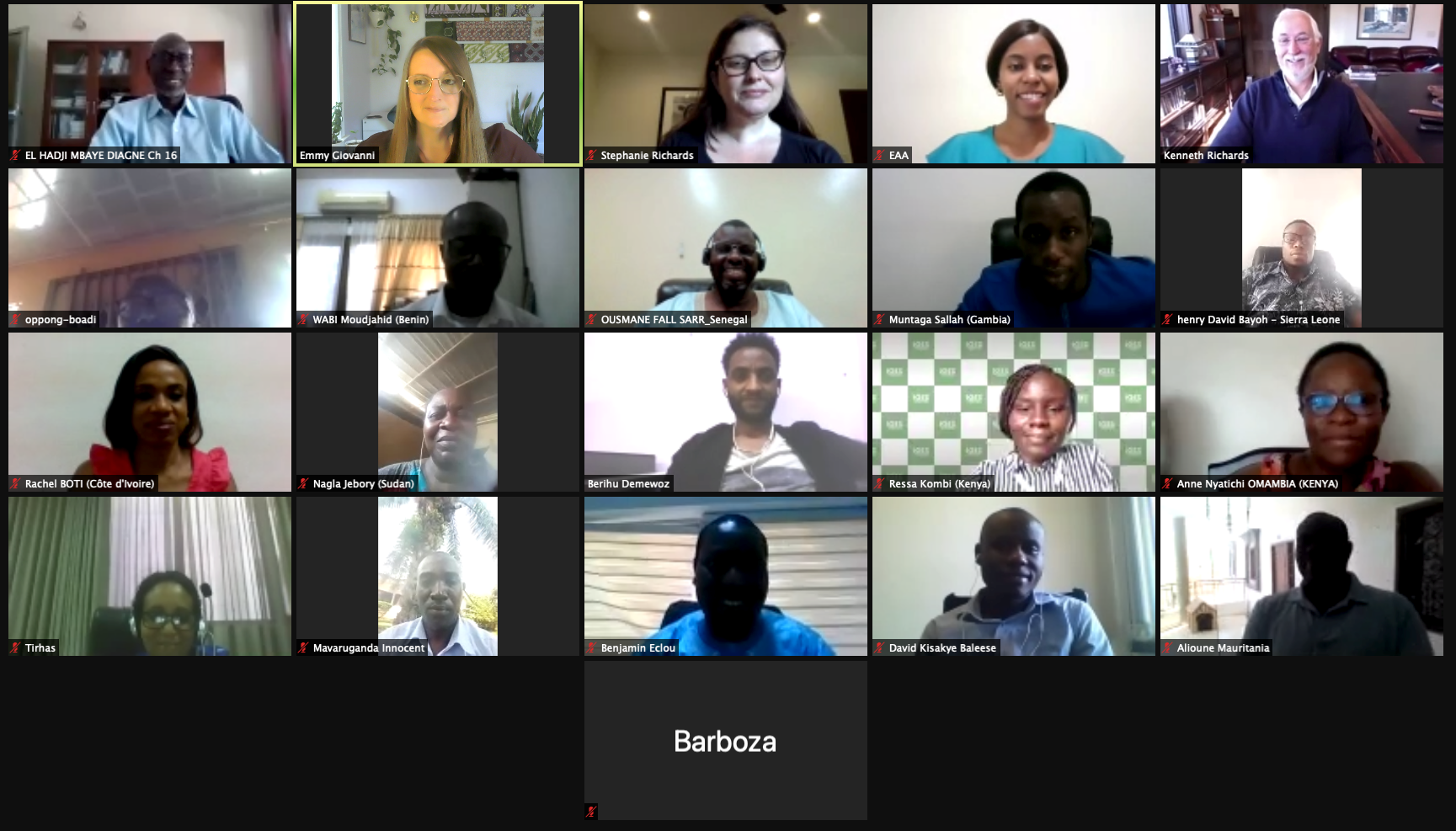

The Eastern and West Africa Alliances on Carbon Markets and Climate Finance collaborated to offer a new online course focused on carbon taxes for policy makers in their respective member countries. It took place between the weeks of April 5 to April 23, 2021 with two 2hour sessions per week.

The course provided participants with the opportunity to learn about the basic principles of carbon tax choice, design, and deployment with an emphasis on applications in the Africa context. It provided interactive online lectures, insights from Africa’s leading practitioners in the field, and supervised exercises focused on the participants’ home countries. Participants who satisfactorily complete all of the course requirements were awarded a certificate.

The course was organized around six modules:

- Why Carbon Taxes? A module focused on basic economic concepts, the range of policy instruments to address climate change and how they compare. Guest Speaker: Peter Odhengo – Senior Policy Advisor Climate Finance/Green Climate Fund NDA, National Treasury

- Preparing for Carbon Tax Design. A module to examine the steps of carbon tax design, identification of objectives (e.g. greenhouse gas emission mitigation, revenue raising, and/or co-benefits), important country-specific factors, and broad design principles. Guest Speaker: Andrew Gilder – Director Carbon Legal South Africa

- Basics of Design and Assessment. A module to review the process of setting the tax base and rate, including a review of potential design approaches and modeling.

- Addressing Carbon Tax Effects. A module to assess cobenefits of carbon taxes as well as potential negative secondary effects, how to design a carbon tax to account for both, and handling of revenues raised from the carbon tax. Guest Speaker: Memory Machingambi – Senior Economist, National Treasury of South Africa

- Modelling carbon taxes. A module to consider institutional design issues, dynamic rollout, MRV (monitoring,reporting, and verification), and communications. Guest speaker: Haileselassie Medhin – Africa Director Of Strategy And Partnerships, WRI

- Evaluating and Adjusting Carbon Taxes. A module to review the importance of carbon tax performance in the years following implementation, the organization of reviews, and adjustments. Guest Speaker: El Hadji Mbaye Diagne – Director General, Africa Energy Environment/ CDM Executive Board Chair

It is hosted by St. George’s University on their SGUx platform. The course development was financially supported by the Collaborative Instruments for Ambitious Climate Action (CiACA) initiative, managed by the UNFCCC, and Banque Ouest Africaine de Developpement (BOAD), with technical support from RCC Kampala, RCC Lome and the World Bank.

The lead trainer was Kenneth Richards, a professor of economics, law and sustainability at the O’Neill School of Public and Environmental Affairs, Indiana University. He was supported by Emily Giovanni, a Senior Consultant for Gnarly Tree Sustainability Institute. Their team has worked extensively in carbon pricing and environmental taxes for the World Bank and collaborated with governments in Africa, Asia, and Latin America to analyze and design carbon taxes and related instruments.

The course is now publicly available here

Sidebar